Global Manufacturing Slumps as Europe and Asia Face Weak Demand, Tariff Risks

Overview

Global manufacturing faltered in November as major economies in Europe and Asia struggled with soft demand, rising tariffs, and persistent economic uncertainty. Fresh purchasing managers’ index (PMI) data indicates renewed contraction in the euro zone, China, and Japan, highlighting ongoing pressures on producers and global supply chains.

Europe: Manufacturing Retreats on Weak Orders

Euro zone factory activity slipped back into contraction, with Germany’s dominant manufacturing sector showing a significant decline in business conditions. Persistent weakness in demand forced companies to reduce their workforce at the fastest pace in seven months.

In Germany, new orders dropped at their quickest rate in 10 months, signaling deepening challenges for Europe’s largest manufacturing hub.

According to Leo Barincou, senior economist at Oxford Economics, current conditions remain fragile, with output trending lower. He attributes this to a combination of tariff pressures, rising competition from China, and broader economic uncertainties. He also noted that manufacturers are struggling to pass higher input costs onto customers due to weak demand, further compressing margins.

Asia: China and Japan Struggle as Output Softens

China, the world’s largest manufacturer, saw factory activity slip into slight contraction, according to a private-sector PMI. This followed Beijing’s official index, which also reported contraction for the eighth consecutive month, though at a slower pace.

Container throughput at Chinese ports was largely unchanged from October, reflecting restrained demand. Zichun Huang, China economist at Capital Economics, noted that even marginal improvements in demand did little to support production due to already elevated inventory levels. The output component fell to a four-month low.

Japan also recorded weakening factory activity, adding to concerns about Asia’s broader industrial slowdown.

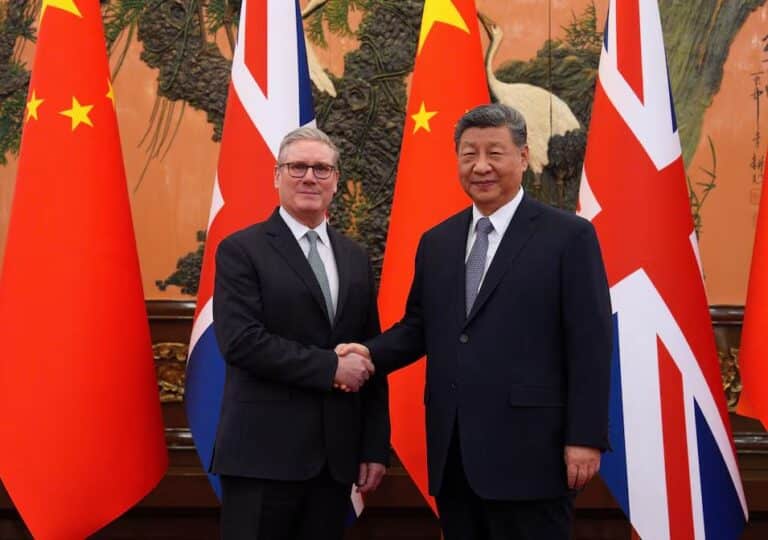

Bright Spots: UK and Southeast Asia Show Growth

While major economies struggled, the UK and several Southeast Asian markets experienced growth in manufacturing. These pockets of resilience were driven by stronger domestic demand and improved export activity, though analysts caution that global uncertainty may limit sustained momentum.

Conclusion

The latest PMI data underscores a challenging global manufacturing landscape marked by weaker demand, rising costs, and ongoing tariff concerns. As companies grapple with declining orders and softening output, policymakers and industry leaders face mounting pressure to stabilize economic conditions and support industrial recovery.